Central Government Scheme for grant of Ex-Gratia payment to Borrowers

[For difference between compound interest and simple interest for six months in specified loan accounts from 1.3.2020 to 31.8.2020]

-Dinesh Gupta, Corporate Law Consultant

Scheme for grant of ex-gratia payment of difference between compound interest and simple interest for six months to borrowers in specified loan accounts (1.3.2020 to 31.8.2020)

Object of the Scheme

The Government of India has come up with a scheme for Ex-Gratia Scheme for grant of ex-gratia payment of difference between compound interest and simple interest for six months to borrowers in specified loan accounts (1.3.2020 to 31.8.2020) (the ‘Scheme’) on October 23, 2020, which mandates ex-gratia payment to certain categories of borrowers by way of crediting the difference between simple interest and compound interest for the period between March 1, 2020 to August 31, 2020 by respective lending institutions. The benefit of the said scheme shall be passed by the Lender Institution to the Borrowers of the specified loan accounts.

This ex-gratia payment scheme is another COVID-19 related relief and incentive by the Government to bear additional interest on certain small specified loan accounts. This scheme is limited only to the borrowers falling under the specified category loan accounts, classified as standard as on February 29, 2020 and having an aggregate exposure of not exceeding Rupees 2 Crores as on February 29, 2020 from all lending institutions. If the facility availed by borrower exceeds Rs. 2 Crores from all eligible lending institutions, then the relief cannot be granted.

The essential idea of the scheme is to provide the benefit of having to pay simple interest by the borrowers covered under the Scheme. The period covered by the two moratoriums is to be taken into consideration under this Ex-gratia Scheme, that is the period from 01.03. 2020 to 31.05.2020 and 01.06.2020 to 31.08.2020. The underlying philosophy of the scheme seems that the central purpose of the moratorium was to grant relief to smaller borrowers whose business/earnings were disrupted by the Pandemic. However, the grant of moratorium did not provide any relief from payment of interest. Thus, interest continued to be compound even while the borrower availed of the moratorium. In many cases, thus, the moratorium hardly helped, as it resulted in mounting of interest burden, which may have even worsened the situation of the borrower.

The Scheme now transforms compound interest into simple interest during the Moratorium Period, that is, the period commencing from 01.03.2020 to 31.08.2020 (‘Moratorium Period’).

We at DSB Law Group have gone through the Scheme announced by the Government, FAQs dated October 26, 2020 and October 29, 2020, SOPs dated October 29, 2020 and have tried to bring the insight of the Scheme in the form of Series of FAQs so that the Lending Institutions and the borrowers should be aware of the eligibility of the borrower and proposed relief to be granted. These FAQs are relevant as on date and the Government might come with more clarification and the may undergone change as many gaps exist as per understanding in different quarters.

The benefit under the Scheme is to be given to eligible borrower by November 5, 2020 by Crediting his account and the eligible lending institution is to file a claim with Nodal Agency by November 15, 2020. If the relief is not granted by the Central Government for any reason whatsoever, no relief would be allowed to the borrower by the lending Institutions. To our mind, the date of November 5, 2020 is very ambitious and it would be difficult of lending institutions to assess the eligibility at such a short date by accessing to Credit bureau data and third party records.

Series- 1/031120

FAQs for Borrowers

1. What is the Eligibility Criteria for Ex-Gratia payment under the scheme?

The borrowers falling under any or more of the “Facilities” (see below) are eligible under Ex-gratia Scheme. However, such facilities need to satisfy the following conditions:

- Such borrower shall not have sanctioned limit or the outstanding amount exceeding Rs. 2 (two) crores in aggregate which ever is higher with all the lending institutions as on 29th February 2020. That is, the sum of borrowings of such a borrower from specified loan accounts with the lending institution providing relief and borrowings other than that with all other eligible lending Institutions shall also be taken into account while arriving at aggregate exposure of Rs. 2 Crores. (For computation of the borrowing cap, see further FAQs below.)

- Such an eligible category loan account should be standard as on 29th February 2020.

- Whether such borrower availed complete moratorium, partial moratorium, or did not avail any moratorium benefit in respect of such eligible category loan account is irrelevant for the purpose of extending benefit under the Ex-gratia Scheme.

2. Does the borrowers have to apply for the relief?

No. The ex gratia relief will be credited to the account of all eligible borrowers without any requirement to apply.

3. Who will finalise the list of eligible accounts?

Individual banks/ lending institutions will finalise the list of eligible borrower for the relief based on the GOI guidelines.

4. Whether crop loans and other agricultural loans are covered in the scheme?

Crop loans and tractor loans etc. are agriculture and allied activities loans and are not part of the eight segments / classes eligible under the scheme.

5. Whether Two-wheeler loans are covered under the scheme?

Automobile loans including two-wheeler loans are eligible under the scheme.

6. Will the loans disbursed after 1st March 2020 qualify for the scheme?

This scheme is limited only to the borrowers falling under the specified category loan accounts, classified as standard and having an aggregate exposure of not exceeding Rupees Two Crores as on February 29, 2020. Therefore, loans disbursed after 1st March 2020 will not qualify for the scheme.

7. Will a loan taken for business purposes by a non-MSME qualify?

Loans to non- MSME for business purpose is not falling under any eligible category of Facilities, and hence not covered under the Scheme. There were some issues related to traders (both retailer and wholesalers) as June 2017 Office Memorandum of MSME Ministry mentioned eight activities including wholesale and retail trade “would not be included in the manufacture or production of goods or providing or rendering of services in accordance with section 7 of the Micro, Small and Medium Enterprise Development Act, 2006.” In other words, wholesale and retail trade will not be categorised as MSME, thus would make things difficult for these businesses to avail benefit under the Scheme. The Government may give a clarification as most of such borrowers falling under the said category would be impacted.

8. A borrower falls under the MSME category as per the new MSME classification. But such a borrower has not availed Udyam Registration, will it be eligible under the scheme?

The borrower must be classified as an MSME on 29th February 2020 irrespective of the classification under the new definition. Further, it is recommended that in case the borrower continues to be classified as an MSME, it may submit its proof of Udyam registration to the lending institution. A declaration from the borrower should also suffice.

9. Will the loan against property (LAP) to individuals qualify as a specified loan account under the scheme?

Loan against property (LAP) is a market term, implying the nature of the security in case of the loan. For the purpose of determining whether the loan is an eligible facility or not, we are not concerned with the nature of the collateral or security. We are concerned with the end-use of the money. Hence, a LAP loan may be a consumption loan, or a business loan to an MSME, or a personal loan to a professional. Therefore, merely because the loan is a LAP, we cannot judge whether it is a qualifying facility or not.

In case a LAP loan is given other than 8 eligible categories/ facilities mentioned above e.g. investment in equity shares of company, purchase of Agriculture Land, Land etc. the same shall not qualify.

10. Does the specified loan accounts cover unsecured loans given by fintech/ MFI entities?

Loans given by Fintech entities or Micro Finance Institutions (MFI) may qualify under the scheme as they may be classified as specified loans under ‘consumption loans’ category. Again loans by such companies given for activities not provided under 8 categories/ facilities shall not be covered.

11. What is the exact manner of passing on the benefit to the borrower? Is it merely a credit to the account of the borrower, or does it lead to any cash benefit being transferred to the borrower?

In our view, the Scheme is simply a limited relief on compound interest. The interest differential as computed under the Scheme is simply credited to the account of the borrower by the 05th November 2020 as specified. Crediting the amount does not mean any actual cash transfer. The interest differential is treated as an amount paid by the borrower. The question of any refund will arise only if the outstanding amount by the borrower is less than the amount of the differential, or the account is fully squared off.

FAQs for Lending Institutions other than the above

1. Is the payment of the ex gratia amount under the scheme, optional for lending institutions or the same has to be complied mandatorily by the lending Institutions?

The payment to the specified loan accounts of eligible borrowers is mandatory under the Scheme. The language of Ex-gratia Scheme clearly provides that the lending institutions shall credit the difference between simple interest and compound interest for a period between 1st March 2020 to 31st August 2020 in specified loan accounts of eligible borrowers.

2. Can a Lending Institution be selective in terms of granting the benefit or denying it to certain Borrowers?

The applicability of the scheme is not optional. As per the Government of India notification, all lending institutions are advised to be guided by the provisions of the Scheme and take necessary action within the stipulated timeline. Hence, the lending institution is obligated to extend the benefit of the scheme to all the eligible borrowers. See below for the meaning of “eligible borrowers.”

3. Which all categories of loans/facilities are eligible under this Scheme?

The loans falling under any of the categories mentioned below are ‘specified loan accounts’ under this Ex-gratia Scheme.

- MSME loans

- Education loans

- Consumer durable loans

- Credit Card Dues

- Automobile loans

- Personal loans to professionals

- Consumption loans

- Housing Loans

4. Which Lending Institutions have to pass the benefits to borrowers under this Scheme?

The following is the list of the lenders have to comply with the operational guidelines of the scheme (“Lending Institutions”):

- Banking Companies

- Public Sector Banks (PSB)

- Co-operative Banks – Urban Co-operative Banks, or a State Co-operative Bank, or a District Co-operative Bank

- Regional Rural Banks (RRB)

- All India Financial Institutions

- Non-Banking Financial Companies registered with the RBI

- Non-Banking Finance Company being a Micro Finance Institution, also a member of Self-Regulatory Organisation (SRO) registered with RBI

- Housing Finance Companies registered with RBI, or National Housing Bank

5. How will the lending institution assess whether a borrower has aggregate loan facilities upto Rs. 2.00 cr from the banking system?

Lending institutions are to assess this on the basis of information available with them as well as information accessible from credit bureaus.

6. Will my Non Fund Based Limits as on 29th February 2020 be included for arriving at the eligibility amount of upto Rs.2 crore?

No. Non fund based limits will not be included for arriving at the eligibility.

7. Whether Accounts categorised as SMA-0, SMA-1 and SMA-2 are eligible to avail the benefit of the package?

Yes, the accounts classified as SMA-0, SMA-1 and SMA-2 as on 29th February 2020 are eligible for the relief package.

8. Are NPA accounts eligible for the relief package?

No. The loan should not be a “Non Performing Asset” (NPA) as on 29th February 2020.

9. Whether “partly disbursed loans” are covered under the relief package?

Yes, provided that the sanctioned or outstanding amounts do not exceed Rs. 2 Cr whichever is higher. The outstanding as on 29th February 2020 shall be the reference amount for calculating the differential interest amount.

10. Which Rate of Interest (%) shall be considered for calculating the package, i.e. RoI (%) considered at the time of sanction or RoI (%) as on 29th February 2020?

- In respect of Education loans, Housing loans, Automobile loans, Personal loans to professionals and Consumption loans, the rate of interest to be applied for calculating the differential interest component shall be the contracted rate as specified in loan agreements/ documentation applicable as on 29th February 2020.

- In respect of consumer durable loans, the rate of interest to be applied for calculating the differential interest component shall be the contracted rate as specified in loan agreements/ documentation. In case where no interest is being charged on equated monthly instalments for a specified period, for the purpose of relief, interest may be applied at MCLR/ Base rate as the case may

- MSME:

- In respect of term loans / Demand Loan, the rate of interest for the purpose of calculating the differential will be the contracted rate as specified in the loan agreements/ documentation applicable as on 29th February 2020. In respect of Cash Credit/ Overdraft, the rate of interest for the purpose of calculating the differential shall be the rate of interest prevailing as on 29th February 2020.

- Credit Cards

- Eligibility: The Credit Card outstanding (i.e. settled amount) in the account as on 29th February 2020 will be the reference amount. Any debits/ credits which are not reflected in the account will not be eligible/ will be excluded.RoI (%): The rate of interest shall be the Weighted Average Lending Rate (WALR) charged by the card issuers for transactions financed on EMI basis from its customers during the period from 1st March 2020 to 31st August 2020.

11. Will I be eligible for relief if my credit card balance is in “Credit” as on 29th February 2020?

No. Ex-gratia will not be paid on those credit cards where balance is in “credit” as on 29th February 2020.

12. What will be the treatment of penal interest/ penalties while arriving at the rate of interest?

The contracted rate/ interest rate prevailing as on 29th February 2020 which is considered for calculating the interest differential will exclude any penalties or any penal rate of interest applied in the account.

13. What will be the treatment for the repayments / credits made in term loan/ demand loan during the period from 1st March 2020 to 31st August 2020?

The outstanding as on 29th February 2020 will be the reference amount for calculating the differential. Any repayment / credits subsequent from 1st March 2020 to 31st August 2020 shall be ignored for the purpose of calculation.

14. How will the interest be calculated for cash credit/ overdraft accounts?

Simple interest for the period will be calculated based on daily outstanding as at end of the day at rate of interest prevailing as on 29th February 2020. Compounding of interest shall be at monthly rests.

15. What is the period to be reckoned for crediting amount under this scheme?

The period to be reckoned for crediting difference between compound interest and Simple interest by the Lending Institutions would be from 1st March 2020 to 31st August 2020 (six months/ 184 days).

16. As on 29th February 2020, a borrower is standard with one lender, but is not standard with another. What will be the eligibility of the borrower in such a case?

In our view, the condition for eligibility for the benefit is that the borrower is standard as on the reference date with the lending Institution eligible for the relief. Additionally, we need to aggregate the facilities enjoyed by the borrower with other lending institutions. We do not have to read any further conditions. That is, if the borrower is not standard with a particular lending institution, then such lending institution shall not grant the benefit to the borrower. However, the lending institution with which the borrower is standard should not be precluded from granting the benefit of the Scheme.

17. A borrower satisfies all other conditions but is classified as NPA as on 29th February 2020 and subsequently becomes standard. Will the borrower be eligible under the Scheme?

The subsequent movement of the NPA to standard will not make the account eligible under the scheme. As per the eligibility conditions, the loan account must be classified as standard as on 29th February 2020

18. Does this Scheme cover the loans which have been securitised or have been subject to Direct Assignment?

The fact that a specified loan account has been securitized or subject to Direct Assignment does not deny the borrower from availing the benefit under this Scheme. As per our view, the borrower is not a party to the Securitisation or Direct Assignment and he is eligible to relief.

19. What is the time period for credit/payment of an ex-gratia amount by the lender?

The scheme provides that the exercise of crediting the amount under the scheme shall be completed by respective lending institutions on or before 05th November 2020.

Therefore, the amount under this Ex-gratia scheme has to be credited to the borrower’s account by the lending institutions within the stipulated time.

20. What is the time limit for Lending Institution to lodge claim to CG?

Each lending Institution will lodge consolidated claim on/ before 15th December 2020. The claim shall be submitted along with the required data as per the template/ format provided by the Nodal Cell of SBI.

21. What is the procedure of claiming Reimbursement by Lending Institutions?

The following procedures need to be complied by all the lending institutions falling under the scheme.

- The reimbursement claim amount should be pre-audited by a statutory auditor of the lending institution.

- A certificate by an auditor shall be attached with the claim.

22. Whether eligible accounts foreclosed during the period of 1st March 2020 to 31st August 2020 are covered under the scheme?

Yes. Eligible accounts foreclosed during the said period are covered under the scheme.

23. Are all types of NBFCs covered under the Scheme irrespective of the asset size?

The Government intends to pass on the benefit of the Scheme through the Lending Institutions including all NBFCs involved in lending to the specified category of borrowers irrespective of the asset size of the NBFCs.

24. Is this scheme applicable on co-lending?

The ex gratia scheme includes loans originated by two or more Lending Institutions. The objective of the scheme is to pass the benefit of the scheme to eligible borrowers. Therefore, in case the borrower is eligible, the benefit under the scheme shall be extended taking blended rate of interest as the reference rate for differential computation of CI and SI during the moratorium period. The rates of interest charged by the respective lenders may be different inter-se; however, the benefit of interest differential will be given to the borrower based on the blended interest rate.

25. What is the mode of adjustment of closed accounts?

For accounts closed during the said period, the period for crediting would be from 1st March 2020 and restricted to the date of closure of such account.

26. Will the gold loans to individuals fall under the specified loan account category?

The answer to this question is far from clear. On one hand, it is possible to contend that most of the gold loans are, in fact, consumption loans. What should matter for the purpose of the Scheme is the end use of the loan and not the nature of the collateral. MoF FAQs have specifically excluded loans taken for investment in financial assets. Gold is not one of the financial assets referred to in the FAQs. However, the purpose of loan taken against Gold is to be seen. If it falls under the above specified 8 eligible categories/ facilities, it should be covered.

27. What is the accounting entry once the claim is computed and made?

The claim once computed and made is credit to the account of customer and debited to ‘Claim receivable from Central Government’.

28. Will the eligibility for MSME Loans be determined as on the date of this scheme or as on 29th February 2020?

The borrower account must fall in the category of specified loan account as on 29th February 2020. For example, a loan account was classified as an MSME as on 29th February 2020 and later on a subsequent change in definition has moved it out of the category of MSME, the benefit under the scheme shall still be given to the said borrower account, subject to fulfilment of the eligibility conditions.

29. When does the Nodal Agency make payment to Eligible lenders?

There is no clear timeline for payment by Nodal Agency to Eligible lenders.

30. Does this Scheme cover Core Investment Companies?

Question does not arise as CICs are intended to provide financial support to “group companies only.

31. Does scheme cover loans against securities or other movable properties?

As clarified by the MoF in its FAQs, loans against fixed deposits [including Foreign Currency Non-Resident (Bank) {(FCNR(B)} account, bonds and other interest bearing instruments], and shares etc., and loans given for investment in financial assets (shares, debentures etc.) are not eligible for coverage under the scheme.

32. A borrower loan account has been closed in the books of the lending institution as on 30th April 2020. However, the borrower was eligible under the scheme as on 29th February 2020. Will the borrower receive any benefit under the Scheme?

Since the eligibility is to be determined as on 29th February 2020, the fact that the loan account has been closed should not deprive the borrower of the benefit under the Scheme.

33. Is there a distinction between secured loans and unsecured loans for the purpose of the Scheme?

No. There is no such distinction. As long as the loan is covered by the list of “facilities” above, it does not matter whether the loan is secured or unsecured.

34. Are Lease entities included in the list of Eligible Lending Institutions?

No, Lease entities included in the list of Eligible Lending Institutions

35. Are NBFCs and HFCs which are not registered with RBI included in the list of Eligible Lending Institutions?

As per the MoF notification dated 23.10.2020, NBFCs and HFCs registered with RBI are eligible for the scheme

36. Shall we aggregate the sanctioned amount or the actual outstanding?

The higher of the two shall be aggregated.

37. If the borrower has availed some Facilities which are not Eligible Facilities under the Scheme, would those also be aggregated?

Yes, the idea of aggregation of all facilities is that the benefit is available only to small borrowers.

38. Where shall the lending institutions file their reimbursement claims after crediting the ex-gratia amounts in specified accounts of eligible borrowers?

The claims shall be submitted to the designated officer (s) /cell at State Bank of India (SBI). The SBI shall act as a nodal agency of the Central Government for settlement of all the claims of lending institutions.

39. Are any overdue instalments or any other overdue charges such as overdue interest, penalty, etc included in outstanding amount as on 29th February 2020?

The amount outstanding as on 29th Feb would include all amounts showing as outstanding from the borrower. If the overdue interest or any other charges have been debited to the loan account, and are shown as a part of the outstanding, in the loan account of the borrower, in our view, the same should form part of the reference amount, both for reckoning the limit of Rs 2 crores, as also for computing the interest differential.

40. What is the timeline for lending institutions to address grievances of borrowers?

Each lending institution was required to put in place a grievance redressal mechanism for eligible borrowers within one week from date of issuance of ex-gratia guidelines i.e. latest by 30th October 2020.

41. Is there a need to establish a separate mechanism for the purpose of this scheme when Lending institutions already have a grievance redressal mechanism in place?

The scheme does not require the lenders to develop a separate mechanism for redressal of grievances arising due to the scheme. The same may be a part of the existing grievance redressal mechanism of the lender. However, the scheme states that the lenders can consider communication dated 1.10.2020 from the Indian Banks’ Association (IBA) in respect of the resolution framework for COVID-19 related stress.

42. What are the requirements under the abovementioned communication from IBA?

The said communication form the IBA lays down the following:

- A web-based platform shall be developed for automatic lodgement and handling of grievances. The grievances may be received on the said portal/branch office of the lender. Grievances received at the branch should also be fed into the portal and the system shall generate a digital receipt for the customer.

- The grievances should be directly handled at zonal/circle level based on the hierarchical structure of the lender. Preliminary remarks should be provided to the customer within a maximum of 72 hours by the Nodal Officer and final response should be provided within 7 working days.

- Escalation matrix may be provided separately for different kinds of loans such as for retail and commercial banking customers. The grievance related to commercial loans may be handled at a higher level.

- The framework should provide for re-opening of the grievance if the customer is not satisfied by the response.

- A dashboard on the status of grievances viz. no. of grievances received, pending status etc. should also be made available to controllers/regulators for close monitoring.

43. Is it mandatory to abide by the above guidelines provided by the IBA?

The scheme does not mandate compliance of the guidelines from the IBA. However, the same may be mandatory for the banks who are members of the IBA (owing to their membership) and recommendatory for other lending institutions.

44. What are the remedies for a lending institution having grievances concerning the Scheme?

Grievances of lending institutions shall be resolved through designated cell at State Bank of India (SBI) in consultation with the Ministry of Finance, GoI. However in respect to the issues/queries related to interpretation of the scheme, the decision of GoI shall be final.

45. What would be the change in ex-gratia payout if loan installments are payable quarterly or semi-annually?

The payment of loan instalment interval i.e. either monthly, semi-annually or quarterly will have no effect on ex-gratia payment computation if the interest rate is compounded with monthly resets.

46. If a Lending Institution has not charged compound interest on the loan, is it still possible to compute CI and avail of the benefit of the Scheme?

If the terms of the loan are clear that the interest shall be simple interest, then the benefit under the Scheme is not even called for.

47. On the credit of Interest Differential, assuming the account was perfectly in order and there was no overdues at all, the Principal Outstanding gets reduced. Does that mean the EMIs will have to be recomputed?

Recomputing the EMIs will involve a substantial hassle. Therefore, ideally, the Lender may either refund the amount to the Borrower or based on borrower’s concurrence, keep the differential as a security deposit/ prepayment for future payments.

48. Is there any need for the Borrower’s loan agreement to be amended?

No, there’s no need for the Borrower’s loan agreement to be amended.

49. Will Inter Corporate Deposits (ICD) qualify as specified loan accounts for the purpose of the scheme?

Inter Corporate Deposits made by the lending Institutions to MSMEs shall qualify as specified loan accounts under the Scheme. Any other ICD to non-MSME entity shall not be eligible under scheme.

Series- 2/041120

1. Whether the Rs. 2 crore limit applies for borrowings across all lending institutions?

Yes, the Rs. 2 crore limit shall be considered across all the lending institutions.

2. What comprises ‘Consumption loans’ mentioned under the categories of loans/facilities eligible under this Scheme?

Consumptions loans seems to be a broad category.It may rather be qualified by exceptions:

- The loan is not a business loan, or a loan for a profession, occupation or calling

- The loan is not for purchase of any financial assets such as shares

- The loan is not for purchase of an asset that cannot be regarded as personal asset

- The loan is granted to a natural person or an HUF, that is, not to artificial entities

Loans without any specific purpose, granted to consumers, will also qualify as consumption loans.

3. What shall be the meaning of the term ‘Housing Loan’?

‘Housing Finance’ shall mean financing, for purchase/ construction/ reconstruction/ renovation/ repairs of residential dwelling units, which includes all other loans including those given for furnishing dwelling units, loans given against mortgage of property for any purpose other than buying/ construction of new dwelling units/ or renovation of the existing dwelling units. Even a loan to a builder for construction counts as a housing loan.

4. What shall the term ‘Educational loans’ mean?

Loans given for educational purposes to a student mean ‘Educational Loans’.

5. Has the pandemic affected repayment of Educational loans?

Typically, the loans have a moratorium until after a certain time of completion of the studies. Hence, there may not be any repayment due during the Reference Period.However, the scheme grants the benefit for such loans too.

6. Will loans to Education Institutes be eligible under education loans?

No, loans given to education institutes will not be covered under the head ‘education loans’.

7. What is the meaning of the word “professionals” in case of personal loans?

In technical parlance, the word “profession” has a narrow meaning. It mostly means those regulated professions where there is a professional body for the purpose of a recognised profession which entitles the professional to practice the same. Examples may be doctors, chartered accountants, architects, etc. However, in the context of the Scheme, it appears that the word “profession” has been used in the wider sense of a profession, vocation or calling, not being in the nature of business. Such a wide meaning is prevalent under taxation laws for recognition of income under the head “business” or “profession”. There does not seem to be sufficient reason for restricting the meaning of the word “profession” for the purpose of the Scheme to only regulated professions.

Hence, there are two types of loans – business loans, and personal loans. Business loans will qualify for the Scheme if the same is extended to MSMEs. Personal loans, to entities other than those engaged in businesses, may either be a personal loan given to a professional, or a consumption loan to a salaried employee. In our view, both the latter categories will qualify.

8. What shall be the meaning of the term ‘Consumer Durable Loan’?

A consumer durable loan is typically for purchase of durables used for personal purposes. For example, TV, washing machine, technological gadgets. A loan for buying a hand phone, laptop, etc. may also qualify.

9. What shall be the meaning of the term ‘Credit Card Dues’?

A credit card is a revolving line of credit used by swiping of a card.

10. Will the virtual credit cards usable through Apps qualify under the scheme?

- A credit card is an on-tap credit facility loaded onto an instrument which can be used by the cardholder to discharge obligations to a third-party, on credit.

- While older definitions talk of an actual ‘card’, taking a broader view of the regulations would imply that apps, downloadable or virtual cards also fall under the same regulatory framework as conventional credit cards.

- Hence, a card does not have t necessarily mean a plastic card, if a revolving line of credit is extended, which is usable by swiping a card or by using an app, it should amount to a credit card.

11. What does the word automobile mean? Does it mean the same as Motor vehicle?

The expression auto loans is typically used in context of loans for motor vehicles, namely,

- Cars

- Two wheelers

- Commercial vehicles

Hence, as long as the item for which loan given is for a motor vehicle, it should qualify as an auto loan.

12. Should the loan necessarily be given for purchase of an automobile, or can the loan be given on security of a motor vehicle?

Usually, the expression auto loan should mean a loan for purchase of vehicle, whether new or old. However, if the loan is given for security of a motor Vehicle, it should fulfil the eligibility of 8 criteria mentioned in the notification. The same should relate to purpose and not to collateral.

13. There are several auto loan renting schemes prevalent these days - will they qualify?

Apparently, auto loan renting schemes will not qualify.

14. Whether loans availed against term deposits are eligible for ex-gratia payment?

Lenders have to consider that the loan account should fall under the specified loan category based on the end use of the loan as well as the type of borrower. The collateral securing such loan is irrelevant.

15. Do the loans given to retail and wholesale traders by NBFCs qualify for the scheme?

The fact that retail and wholesale traders are excluded from the definition of MSME would imply that they shall not fall under the category of ‘MSME loans’. However, in case the end use of the loan is for consumption by the trader, the same can qualify as ‘consumption loans’.

16. Will a loan given to a practising CA or CS firm qualify as a personal loan to professionals? Can it be classified under the head “MSME loans” in case the firm is registered as MSME?

The loan given to a practicing CA or CS (for purposes other than business) shall qualify as a personal loan to professionals. Further, a loan given to a practising CA/CS firm for business purposes can be classified as ‘MSME loan’ provided the firm is registered as an MSME or a declaration to that effect is provided.

17. Where there is a loan transfer, that is, shifting of the loan to another Lending Institution during the Reference period, what will be the treatment?

The Transferor Lender will be able to give credit only upto the date of the loan transfer. Transferee Lender will not give any credit.

18. Does this Ex-gratia Scheme mean that no interest will be charged by the lending institutions for the period of 01.03.2020 till 31.08.2020 on specified loan accounts?

No, this Ex-gratia scheme is in the form of waiver of interest on interest in the specified loan account category, irrespective of whether moratorium benefit was extended/availed completely, partially or not availed at all on such loan accounts.

Therefore, all the eligible borrowers in specified loan accounts will receive payment under the Scheme from their respective lending institution. The credit amount would be such part of interest which would have been chargeable by the lending institutions on the accrued interest component during the six months deferment period from 29.02.2020 till 31.08.2020. That is the difference between the Compound interest and Simple Interest on the outstanding amount will be payable by the lending institution which shall be reimbursed to them by the Government.

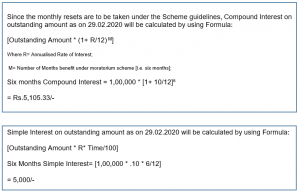

Illustration:

Outstanding loan amount in the specified loan account as on 29.02.2020 was Rs. 1,00,000 (Rupees One Lakh).

Interest Rate as applicable on such a loan account as on 29.02.2020 is taken @ 10% annualised rate, compounded monthly.

Therefore, the balance 105.33/- shall be credited to the specified account of the borrower by the lending institution.

19. A borrower loan account has been closed in the books of the lending institution as on 30.04.2020. However, the borrower was eligible under the scheme as on 29.02.2020. Will the borrower receive any benefit under the Scheme?

Since the eligibility is to be determined as on 29.02.2020, the fact that the loan account has been closed should not deprive the borrower of the benefit under the Scheme.

Such borrowers are eligible for refund of differential interest from 01.03.2020 upto the date of closure of account.

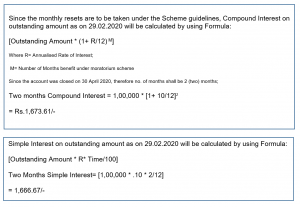

Illustration:

The outstanding amount in a specified loan account as on 29.02.2020 is Rs. 1,00,000 (Rs. One Lakhs Only). The borrower paid all the dues towards the loan amount by 30.04. 2020. The contracted annualised rate compounded monthly as on 29.02.2020 is at 10%.

The ex-gratia payment as under the scheme guidelines should be as follows:

Therefore, the borrower shall be entitled to Rs. 6.94 under the ex-gratia scheme.

It will be credited to the borrower’s savings/ current account. If no such account is maintained by the borrower with the lending institution, the borrower can advise the lending institution the details of the account in other banks where the amount can be credited /remitted to.

20. Will the treatment of loans that have matured during 01.03.20 to 31.08.20 but are still active in system due to some pending charges, be same as closed loans?

If the loan has been closed during the reference period, and there are pending charges, the treatment shall be the same as a foreclosed account. Accordingly, the credit for differential interest amount can be adjusted with the overdues.

21. What if the loan is closed in between the month (say 10th of May) how to compute compound interest in such a situation?

The interest shall be computed for the broken period by converting the number of days into a fraction of the month. The same can be done by dividing the number of days by 30 (considering a month has 30 days on average).

Series- 3/041120

1. A borrower account was standard as on 29.02.2020 and also satisfies all the other eligibility conditions under the scheme, but as on date is an NPA. Can the benefit still be availed?e

Yes, the benefit shall still be given to the borrower based on the fact that the loan account was eligible as on 29.02.2020.

2. When will the eligibility be determined, as on the date of this scheme or as on 29.02.2020?

The borrower account must fall in the category of specified loan account as on 29.02.2020. For example, a loan account was classified as an MSME as on 29.02.2020 and later on a subsequent change in definition has moved it out of the category of MSME, the benefit under the scheme shall still be given to the said borrower account, subject to fulfilment of the eligibility conditions.

3. A borrower has not availed Udyam Registration, but falls under the MSME category as per the new MSME classification, will it be eligible under the scheme?

The borrower must be classified as an MSME on 29.02.2020 irrespective of the classification under the new definition. Further, it is recommended that in case the borrower continues to be classified as an MSME, it may submit its proof of Udyam registration to the lending institution.

4. Is Udhyam Registration mandatory for MSME classification?

As per the eligibility conditions, the lender has to ensure that the borrower account was a classified as MSME loan as on 29.02.2020. Further, on the said reference date, obtaining udhyam registration was not mandatory for the purpose of MSME classification. However, a declaration may be sought from the borrower in this regard that they were eligible to be classified as an MSME on such reference date.

5. A salaried employee / self-employed professional had availed of a personal loan from bank which has some amount outstanding as on 29.02.2020. Is the loan eligible for ex-gratia payment under the scheme?

Yes. Loans for consumption purposes (e.g., social ceremonies, personal expenditure, etc.) are also eligible for coverage under the scheme, besides other specified categories of loans like consumer durables, automobiles, education, credit card dues, housing and personal loans to professionals.

6. If a Lending Institution has not charged compound interest on the loan, is it still possible to compute CI and avail of the benefit of the Scheme?

If the terms of the loan are clear that the interest shall be simple interest, then the benefit under the Scheme is not available.

7. In case of EMI-based loans, where there is no formal declaration or disclosure of a compound interest, but an IRR or effective interest rate is computed, can it be implied that there is a compound interest? In essence, can it be contended that IRR and compound interest are the same?

In the cases where an IRR or effective rate is charged from the borrower, the EMI computation already factors the interest compounded over the loan tenure. In case the borrower has availed moratorium, the amount is accrued but not payable. Therefore, interest charged over the interest component of the amount accrued during moratorium period shall be the ex-gratia amount and the same will be credited to borrowers account. In case the borrower has not availed moratorium, the borrower pays the amount on its accrual. The EMI computation however, already considered the compounding effect of the interest. Hence, the ex-gratia amount shall be the interest compounded during the Reference Period.

8. In several forms of lending, it is a common practice for lenders to charge a “flat rate”, that is, a rate of interest computed with reference to the original loan, even though the borrower continues to pay the EMIs over time. In such a case, is the Scheme applicable?

The RBI specifically instructs the lenders to disclose an annualised rate of interest, irrespective of the payment terms. The annualised rate is the IRR which is the contractual term agreed between the parties. Hence, the Scheme benefit shall be applicable and the computation of simple interest and compound interest shall be based on such IRR.

9. What if the contractual rate is 0%, will benefit under the Scheme still be provided?

In case the contractual rate is NIL or 0%, there is no question of granting any benefit to the borrower, given that the borrower has not paid any interest at all. However, in case the loan account falls under the category of consumer durable loan and no interest is charged for a specified period, then lender’s base rate or marginal cost of funds based Lending Rate (MCLR) whichever is applicable shall be considered as on 29.02.2020 to calculate the differential amount of interest. [Updated as of 02.11.2020]

10. The Scheme provides that in case of consumer loans where there is no interest, there may still be an imputed interest based on the lender’s base rate / MCLR whichever is applicable. Can the same principle be applied in case of loans where only simple interest is charged?

The Scheme specifically mentions the treatment in case of consumer durable loans where there is no interest charged by the lender for a specified period. However, in case simple interest has been charged that would essentially mean that the lender has forgone its interest over the accrued interest. Hence, the same shall not be eligible for benefit under the scheme.

11. What will be eligibility of a borrower under Scheme in any of two scenarios covered below? ---Scenario 1: The borrower has taken moratorium benefit until the first three months under moratorium scheme, i.e. from 01.03.2020 till 31.05.2020. --- Scenario 2: The borrower has taken the moratorium benefit for the last three months of the moratorium scheme, i.e. from 01.06.2020 till 31.08.2020.

Yes, the borrower shall be eligible for ex-gratia payment in both of the scenarios mentioned above. The Ex-gratia scheme is applicable on all the specified loan accounts, whether moratorium benefit is completely availed, or partially availed, or not availed at all.

All the payments made by such a borrower towards its eligible loan account between 01.03.2020 and 31.08.2020 will be ignored. For the purpose of uniformity, the difference between compound interest and simple interest is to be reckoned at an outstanding amount as on 29.02.2020 for a period of six months.

12. Will it be right to say that all specified accounts of eligible borrowers are entitled for Ex-gratia payment under the scheme, irrespective of whether payment deferment have been availed or not under the moratorium scheme?

Yes, all the specified loan accounts of eligible borrowers are entitled to ex gratia payment under the Ex-gratia Scheme.

13. Will the lending institutions continue to charge over dues and other penal interest on borrower’s account even including those to whom the benefit is granted under the scheme?

Yes. The ex-gratia scheme’s objective is to pass the differential benefit of compound interest and simple interest in specified loan accounts by crediting such loan accounts of eligible borrowers.

All the over dues charges and other penal interest shall continue to apply on all borrowers as may be applicable.

Disclaimer :

The view expressed by the author are his own views and any reliance on the same does so at one’s own discretion. This is not intended to be a professional advise or opinion.